Don't Just Mitigate the Risk. Anticipate Your Opportunities

Customize PathFinder AI to meet your CRA and Fair Lending goals. Tailor real-time insights for loan officers at the point of sale, ensuring compliance and informed decisions. Stay ahead with updates on trends and census changes, keeping your team aligned with evolving regulations.

How It Works

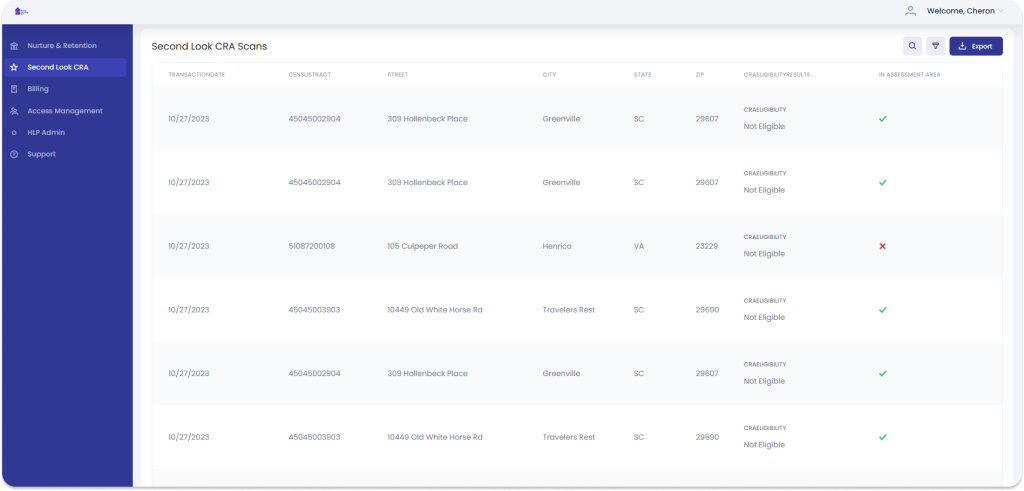

FirstLook CRA is a game-changing tool for bank CRA professionals. It integrates CRA and LMI data with geospatial insights, providing loan officers real-time guidance at the point of sale. This boosts CRA performance and helps close more loans for eligible applicants, instantly rescuing qualified borrowers and ensuring compliance.

Automate manual processes to increase loan pull-through.

Reduce risk with proactive CRA management at the top of the sales funnel

Streamline loan officers' daily workflows with minimal disruptions

Instant Fair Lending Validation

Pathfinder’s AI-driven SaaS streamlines CRA assessments, focusing on 3 data points and automating workflows to enroll near-mortgage-ready applicants into your rewards program. Our AI ensures compliance, boosts loan officer productivity, and increases revenue by letting your team focus on closing more loans efficiently.

Easy Encompass Plugin or API integration

FirstLook CRA empowers lenders to proactively identify high-impact CRA opportunities with real-time insights and comprehensive data. Within weeks, lenders can ensure compliance, drive community development, and see meaningful results. Pathfinder integrates seamlessly with multiple platforms, offering complete flexibility and quick impact.

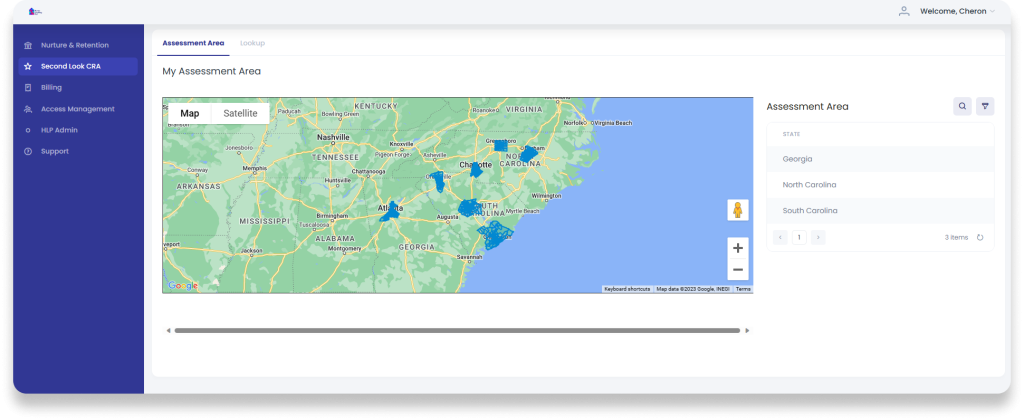

Amazing tools to monitor CRA Eligibility

FirstLook CRA guarantees a 5% boost in closed loans for both mortgage and retail products by proactively identifying high-value CRA-eligible opportunities. Our solution not only ensures seamless CRA compliance but also drives measurable growth, enabling lenders to expand their reach and make a significant impact in underserved communities.